I. Strategic Market Overview and Competitive Segmentation

The competitive landscape for deals, discounts, and event platforms in the United Arab Emirates is defined by a fierce struggle between two fundamentally opposed business models: the horizontal aggregation of Super-Apps and the deep vertical specialization of Niche Platforms. The UAE, being the region’s most mature digital marketplace, provides fertile ground for this conflict, propelled by a technology-savvy population and mandated digital identity frameworks. With the e-commerce market robustly valued at 293.58 billion AED and forecast for substantial growth, the fight centers on capturing and retaining consumer attention, which overwhelmingly resides on mobile platforms—smartphones contributed 79% of all e-commerce sales in 2025.

A. The Ecosystem Dichotomy: Niche Specialists vs. Super-App Forces

The market is currently polarized. On one side are the Super-Apps, characterized by their horizontal expansion and focus on convenience. Careem exemplifies this approach, aiming to be the “everything app” by providing mobility, food, grocery delivery, and fintech solutions. This strategy is driven by the “insatiable need for convenience” felt by UAE residents, many of whom prefer to consolidate multiple services into a single, multi-faceted platform. For these platforms, the objective is not just to facilitate a transaction but to compete for user devotion across their entire digital life.

Opposing them are the Niche Specialists, whose survival hinges on offering superior depth, value, or a critical technological solution within a constrained vertical. Platforms such as The Entertainer (focused on BOGO lifestyle incentives), Platinumlist (specialized event ticketing infrastructure), Fresha (B2B software for wellness and beauty), and Rayna Tours (deep B2B and B2C travel/DMC services) maintain relevance by providing value that horizontal apps cannot easily replicate.

B. The Asymmetric Warfare of Capital and Data

A defining characteristic of this competitive environment is the structural financial difference between the two camps. Super-Apps, having secured massive capital backing Uber’s acquisition of Careem and subsequent investment from e& (Etisalat by e&) can afford to treat deals, offers, and discounts (such as Careem Dine Out or event ticketing integrations) not as primary profit centers but as powerful cost-of-retention tools.

Cost of retention is the total expense a business spends to keep existing customers engaged and loyal, including things like loyalty programs, discounts, customer support, and marketing campaigns.

👉 In short: it’s how much it costs to keep a customer vs. acquiring a new one.

The financial scale of these entities allows them to cross-subsidize losses in a deals vertical using the profitability and volume generated by their core mobility or fintech segments.

In contrast, platforms whose primary or sole business relies on offering deals (like Cobone or The Entertainer) must ensure their discounts generate immediate, dedicated profit. This reliance on deals for core revenue places Niche Specialists at a profound disadvantage, as they cannot sustainably match the subsidized pricing strategies of Super-Apps. This forces niche platforms into difficult strategic choices: either retreating to hyper-specialization (Fresha, Raynatours) or reinforcing the absolute core value proposition (The Entertainer’s non-negotiable BOGO guarantee).

A powerful defense mechanism against this overwhelming Super-App aggregation is the establishment of a B2B Software-as-a-Service (SaaS) moat. While Careem and its peers dominate B2C aggregation, platforms like Fresha in the spa and salon sector and Platinumlist in the events space are building high switching costs by becoming indispensable operational partners for merchants. By providing the core software for scheduling, POS, inventory, and detailed customer data management, they embed themselves deep within the merchant’s operational workflow.

II. The Battle for the Screen: User Experience, Trust, and Technological Agility

User Experience (UX) in the UAE’s mobile-dominant market is not just about aesthetics; it is the fundamental driver of trust and conversion. The competitive analysis reveals stark differences in UX quality, trust mechanisms, and the sophistication of personalization technology between the Niche Specialists and the Super-Apps.

A. The UX Penalty of Transactional Deals Platforms

For many transactional deal platforms, the user journey is plagued by issues of perceived deception and high friction, resulting in a demonstrable erosion of customer trust. Platforms such as Cobone face explicit consumer complaints that the perceived value is undermined by the alleged manipulation of original retail prices. Users report that discounts are applied to “fake original prices,” resulting in a real saving of only around 5%, not the advertised 50% or 60%. This perception of price inflation undermines the platform’s core premise, leading to an Inverted Price Elasticity of Trust.

Further damaging the user experience is the documented friction during deal redemption at the point of service. Merchants, particularly in the Food & Beverage sector, are sometimes reported to engage in tactics to avoid honoring deals offered through platforms like The Entertainer. This includes staff purposefully canceling orders, claiming technical difficulties with scanning voucher codes, or fabricating reasons not to deliver, demonstrating a critical failure in contractual fulfillment and enforcement on the platform side.

B. Super-App UX: Ubiquity and Frictionless Integration

Super-Apps counter these friction points with ubiquity and seamless transactional flows. They benefit immensely from the UAE’s maturing digital payments infrastructure, including the widespread adoption of digital wallets and the integration of financial instruments like Buy Now Pay Later (BNPL), which reached 8.99 billion AED in payments in 2025. This infrastructure allows Super-Apps to provide highly simplified and secure mobile payment experiences, crucial for high conversion rates.

This brings to light a critical UX factor related to third-party integration. When Super-Apps rapidly expand by incorporating external services via API, they rely heavily on the quality control of those external partners. If the user receives a poor service experience (e.g., a late delivery or an unreliable rental car) from a third party booked via the Super-App, the Super-App itself bears the full reputational damage. The future UX challenge for these platforms will therefore pivot from achieving mere integration volume to establishing rigorous governance and standardization across all third-party experiences, dedicating heavy investment to quality assurance to prevent a fragmented, negative experience from undermining overall trust.

C. AI and Hyper-Personalization as the New UX Battleground

In response to the growing demand for customized experiences, both major models are turning to Artificial Intelligence (AI) to enhance discovery and relevance.

The Entertainer has strategically launched H.A.P.I.™ (Helpful Artificial Personalized Intelligence), positioning it as a tool to modernize the platform, streamline offer discovery, and provide a simplified experience. This is a necessary move, as e-commerce trends in the UAE strongly favor AI-driven personalization to boost customer engagement and loyalty.

However, Super-Apps like Careem possess a distinct data superiority. Careem operates as an “AI-driven company,” leveraging its vast cross-vertical data (mobility, payment, delivery, food) to predict demand with 90% accuracy and accelerate experiment analysis from days to minutes. This means Careem’s ability to deliver dynamic pricing, hyper-relevant offers, and targeted loyalty rewards far surpasses that of single-vertical niche competitors. Platforms that remain reliant on static listings and basic search functions (as Cobone currently appears to be) will rapidly become obsolete in a market where AI is increasingly dictating the consumer’s discovery journey.

III. Merchant Economics, B2B Leverage, and Revenue Model Stability

The long-term competitive health of these platforms is directly tied to the stability of their revenue streams and their ability to create sustainable leverage against their merchant partners. This analysis contrasts the stability of subscription models against the volatility of transactional models and highlights the defensibility offered by B2B SaaS solutions.

A. Subscription vs. Transactional Monetization Stabilit

The Entertainer operates on a dual B2C and B2B model. Its B2C segment relies on the annual subscription fee paid by consumers for access to thousands of Buy One Get One Free (BOGO) offers, establishing a steady stream of recurring revenue. This subscription base provides crucial financial stability. On the B2B side, merchants pay an initial sign-up fee (deposit), and then a percentage of the savings realized by the customer for each voucher redemption.

Conversely, Cobone relies primarily on a transactional marketplace model, generating revenue from direct voucher sales and subsequent commission on high-volume, deep-discount offerings. This model is highly volatile, as revenue is dependent on continuous customer acquisition and the aggressive daily performance of Electronic Direct Mailers (EDMs). This transactional fragility, coupled with the consumer trust issues surrounding price transparency, results in an unpredictable revenue structure highly vulnerable to market shifts.

It is well-documented that while B2B SaaS models tend to exhibit lower customer churn, B2C subscription models like The Entertainer typically endure higher churn rates due to customer price sensitivity. However, this is partially mitigated by the shareable membership feature, which allows consumers to distribute the value across multiple users, creating an added layer of stickiness.

The competitive structures of the primary players are summarized in the following table:

Competitive Landscape Segmentation and Core Value Proposition

| Platform | Primary Model Type | Core Revenue Mechanism | Key Strategic Differentiator | UX Focus/Latest Tech |

| Careem | Super-App (Everything App) | Transaction Commission + Subscription (Careem Plus) | Ubiquity, ecosystem integration, financial services (FinTech) | AI-driven matching, modular service integration [5, 24] |

| The Entertainer | Niche/Subscription (B2C/B2B) | Annual B2C Subscription Fee + B2B Merchant Fee | Guaranteed BOGO value proposition, shareable family membership | AI-Powered Personalization (H.A.P.I.™) [20, 21] |

| Cobone | Niche/Transactional Marketplace | Direct Sales/Coupon Volume Commission | Deep, high-discount one-off deals, group buying power | High-volume transaction processing, daily EDMs (but high trust risk) [13, 28] |

| Platinumlist | Niche/Events & Ticketing | Ticketing Commission (% of face value/fee) | Event Organizer B2B software, segmented digital marketing expertise | Seamless gateway integration, white-label solutions, data analytics dashboards [10, 35] |

| Fresha | Niche/Wellness Booking (B2B SaaS) | B2B Subscription + New Customer Acquisition Fee (20%) | Merchant management software, operational platform lock-in for salons/spas | Integrated POS/Payments, no-show fee mitigation [11, 32] |

| Raynatours | Niche/Travel & DMC | B2C Package Sales + B2B Wholesale/MICE solutions | Vertical integration, historical B2B travel and destination management expertise | Diverse B2B/B2C platforms, strong regional presence [12] |

IV. Maximizing Reach: Aggressive Marketing and Localization Strategies in the UAE

The aggressive marketing landscape in the UAE requires platforms to employ highly tailored strategies to cut through the noise, reduce the skyrocketing Customer Acquisition Cost (CAC), and align messaging with the region’s diverse cultural demographics.

A. Strategic CAC Reduction through Bundling and Partnerships

Super-Apps leverage their diversified platforms to drastically lower the effective CAC for specific deals verticals through bundling. Careem, for instance, markets its Careem Plus subscription, which bundles discounts across multiple services, including free delivery, cashback on rides, and substantial discounts on Dine Out bills. Critically, this membership is frequently bundled via strategic financial and telecommunications partnerships, such as promotions offering free access through Emirates NBD (ENBD) or Virgin Mobile. By partnering with large organizations with existing customer bases, Careem effectively offloads the CAC for its deals segment onto the marketing budgets of banks and telcos.

Niche platforms must find alternative, low-cost acquisition strategies. The Entertainer excels in this through its social lock-in mechanism, allowing users to share their annual membership with up to three family members. This feature transforms the single purchase into a powerful referral tool, exploiting existing social and familial networks for high organic acquisition and retention at a minimal marginal cost.

B. Digital Marketing Sophistication and Data Segmentation

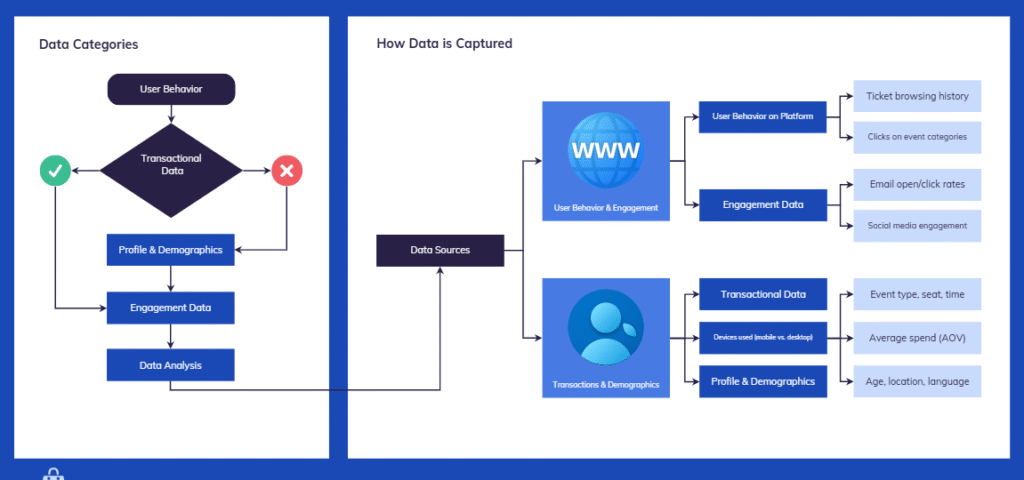

Success in UAE e-commerce depends heavily on precision digital targeting. Platinumlist serves as a prime example of a niche platform excelling in B2B marketing support. They offer event organizers advanced, data-driven tools that facilitate user segmentation based on interests, behavioral data, and user profiles.

1. How Data is Captured

User Behavior on Platform:

- Ticket browsing history (e.g., viewing car shows, concerts, or family festivals)

- Clicks on event categories (sports, business conferences, exhibitions)

- Abandoned carts (user looked at tickets but did not complete purchase)

Transactional Data:

- Event type purchased, seat category, time of purchase

- Average spend per transaction (AOV)

Profile & Demographics:

- Age, location (Dubai, Abu Dhabi, Sharjah), language preference

- Devices used (mobile vs. desktop)

Engagement Data:

- Email open and click rates

- Social media engagement (campaign clicks from Meta/Google Ads)

2. What Data is Captured (Examples)

- A user buys VIP tickets to the Dubai Motor Show → captured as high-spend + automotive interest.

- A user repeatedly browses family events but doesn’t buy → tagged as family segment / high intent but low conversion.

- A user engages with English-language comedy shows newsletters → tagged as expat entertainment segment.

3. How Segments Are Created

Platinumlist builds audience cohorts based on these inputs. For example:

- Segment A – Automotive Enthusiasts: Users who viewed or purchased motor shows, car expos, or auto races.

- Segment B – Family-Oriented: Users who engaged with children’s activities, festivals, or family bundle tickets.

- Segment C – High-Spend Entertainment Seekers: Frequent buyers of premium concerts, theater, or VIP packages.

- Segment D – Dormant Users: Accounts created but no transactions in the last 6 months.

These segments can be refined with propensity scoring (likelihood to buy again, upgrade to VIP, or convert from browsing to buying).

4. Multi-Touch Activation (Concrete Example)

Let’s take Segment A – Automotive Enthusiasts during the Dubai International Motor Show:

- Pre-Event Awareness:

- Personalized email campaigns showing early-bird Motor Show offers.

- Retargeted ads on Meta/Google when the user searches for “Dubai car expo” or browses auto-related content.

- Personalized email campaigns showing early-bird Motor Show offers.

- Consideration Stage:

- Push notifications with limited-time offers (“VIP tickets almost sold out”).

- WhatsApp marketing reminder with easy checkout link.

- Push notifications with limited-time offers (“VIP tickets almost sold out”).

- Conversion Stage:

- Dynamic remarketing showing tickets still in their cart or similar auto events.

- Discount code sent via email for upselling (“Buy 2 VIP tickets, get free parking”).

- Dynamic remarketing showing tickets still in their cart or similar auto events.

- Post-Purchase Loyalty Activation:

- Personalized recommendations for similar events (Formula 1 Abu Dhabi, car modification expo).

- Loyalty rewards (points or discounts) to encourage repeat purchase.

- Personalized recommendations for similar events (Formula 1 Abu Dhabi, car modification expo).

✅ In practice:

The platform’s sophistication lies in capturing granular behavioral and transactional data, turning it into micro-segments, and then orchestrating multi-channel touches (email + WhatsApp + ads + push notifications). This ensures that a user sees consistent, relevant messaging across platforms until they convert — and keeps them in the funnel for future events.

C. Localization and Cultural Intelligence

The multicultural nature of the UAE requires sophisticated localization strategies. Research indicates that achieving success hinges on cultural alignment and trust. For example, 72% of UAE consumers report trusting influencers more than traditional advertisements, and 65% purchase products endorsed by local figures. Furthermore, the engagement rate for Arabic content is 35–50% higher than for translated English content.

Platforms that recognize this are investing accordingly. Platinumlist, in a clear strategic move to support regional growth, underwent a platform redesign that included developing a new Arabic typographic system and adapting its logo to align with cultural inclusivity. Beyond mass marketing, the trend globally, and increasingly in the UAE, favors shifting budgets toward nano and micro-influencers. These niche creators offer authentic connections that drive superior results over pure reach metrics, forcing deals platforms to engage with specific vertical influencers (F&B, wellness, travel) to maintain credibility.

A summary of the merchant value provided by the competing models highlights the data advantage held by Super-Apps:

B2B Merchant Value Proposition vs. Super-App Negotiation Leverage

| B2B Value Metric | Niche Platforms (e.g., Entertainer, Fresha) | Super-Apps (e.g., Careem Dine Out) | Strategic Implication |

| Merchant Cost Structure | High fixed annual/software fees; higher variable commission on new clients (Fresha 20%) [11]. | Lower perceived fixed fees; variable commission on all volume; reliance on cross-subsidization. | Niches monetize software and incremental leads; Super-Apps monetize volume and platform dependency. |

| Merchant Pain Point Solved | Operational efficiency, scheduling, POS/inventory management (Fresha) [32]. | Fill excess capacity during low demand periods; immediate mass exposure. | Niches solve internal management problems; Super-Apps solve external traffic problems. |

| Data Access & Insight | Highly specialized, proprietary customer behavior data (e.g., spa preferences, voucher redemption patterns) [35]. | Extremely broad behavioral data (transport, payments, delivery, dining history) [24]. | Super-Apps possess asymmetric, high-value data enabling superior B2B negotiation and dynamic pricing enforcement [36]. |

| Redemption Friction | High friction; staff resistance documented [16]. | Low to moderate friction, often integrated with native payment/delivery systems. | Friction correlates directly with lack of B2B operational lock-in. |

V. Engineering Customer Devotion: Churn Mitigation and CLV Maximization

The ultimate measure of platform success is its ability to build long-term loyalty and maximize Customer Lifetime Value (CLV) by mitigating both voluntary (active cancellation) and passive (payment failure/inactivity) churn. The competition in the UAE has shifted from vying for mere convenience to competing for true emotional devotion.

A. Loyalty Program Structure and Stickiness

The Entertainer’s core retention strength is built on a sophisticated social mechanism. The annual subscription model, often generating high savings (reported by users to be between AED 6,000 and AED 10,000 annually), is structurally reinforced by allowing the membership to be shared with up to three people. This creates a powerful social lock-in, making the decision to cancel a shared, familial decision rather than a simple individual transaction, significantly increasing the friction of voluntary churn.

Careem combats churn through its value-added Careem Plus bundling. This loyalty program focuses on embedding the Super-App into daily life by offering utility-based, non-monetary benefits such as priority support from top agents, alongside tangible discounts like cashback on rides and unlimited free delivery. The objective is to establish a compulsory “habit loop” where the cost of the subscription is instantly justified by the services required for routine urban living.

A critical component of the Super-App’s retention strategy is the principle of Mandatory Habitual Integration. Careem’s move to integrate Hala Taxis—the official RTA regulated transport—directly into its platform forces high-frequency usage based on utility and necessity, regardless of promotional offers. When a digital service transitions from a discretionary discount app to an indispensable logistical or financial utility (e.g., payments, official transport), its retention stability becomes virtually impenetrable to competition from pure deals platforms.

B. Mitigating Price Sensitivity and Fatigue

Voluntary churn is often accelerated by “promo fatigue” and the perception that deal quality has declined. The Entertainer’s adoption of AI with H.A.P.I.™ is a targeted operational response aimed at increasing the relevance of offers, thereby reducing the mental burden of sifting through irrelevant deals and validating the annual subscription fee.

In general e-commerce, customer sensitivity to price increases is moderated by the length and breadth of the relationship. For platforms like Cobone, where the relationship is highly transactional and perceived trust is low due to alleged fake discounts, any increase in price or shift in the deals offered leads to immediate, severe retention consequences. For Super-Apps and entrenched subscriptions like The Entertainer, the breadth of services or the upfront investment of the annual fee provides a buffer against minor price shocks.

C. The Lifetime Value Disparity

The competitive strength of the Super-App model is fundamentally rooted in the Lifetime Value (LTV) Disparity enabled by their cross-vertical data collection. A transactional platform like Cobone captures data only on specific, infrequent deal purchases (e.g., one spa visit, one buffet voucher). Careem, by contrast, captures mobility patterns (commutes, neighborhoods), financial transactions, food delivery preferences, and dining-out history. This rich, multi-dimensional data profile allows Super-Apps to accurately project a far higher LTV for the average user, justifying aggressive front-end subsidies, such as offering Careem Plus free for six months via a bank partnership, to secure the customer and embed the usage habit.

The importance of emotional connection is rising. Loyalty programs featuring active community engagement are significantly more appealing, with 70% of consumers reporting they would be more likely to join such a program. However, many Super-Apps still suffer from “weak relational value” and a lack of community-based features. This community gap represents a clear future opportunity for niche platforms, especially those focused on social experiences like events (Platinumlist) or group dining (The Entertainer), to develop community-centric retention mechanics that foster emotional devotion and secure long-term loyalty.

The core retention mechanisms across the competitive set are structured as follows:

Retention Mechanisms and Churn Mitigation Strategies

| Platform Model | Primary Retention Mechanism | Key Churn Mitigation Tactic | Vulnerability/Risk |

| Subscription Niche (Entertainer) | Annual fee, high perceived monetary savings (AED 6k-10k p.a. saved) [16] | Shareable membership (social lock-in), H.A.P.I.™ personalization [20, 38] | Merchant friction and perceived devaluation of deals [16, 45] |

| Super-App (Careem) | Cross-subsidized Careem Plus bundle (free delivery, cashback, priority support) [37] | Habitual utility integration (Rides, Payments, Hala Taxi), AI-driven reliability [24, 44] | Promo fatigue, fragmented/siloed user experience across verticals [8] |

| Transactional Niche (Cobone) | Daily high-volume email newsletters/EDMs [28] | Frequent discount codes (short-term incentive) [28] | Low structural loyalty, extreme price sensitivity, acute trust erosion from “fake discounts” [13, 48] |

| B2B SaaS Niche (Fresha) | Merchant operational lock-in (software reliance) [11] | No-show/cancellation fee implementation [32] | Relies on continuous flow of new clients from marketplace; marketplace value must justify high 20% commission. |

B2B Defensibility vs. Super-App API Strategy

To what extent are niche vertical platforms (e.g., Fresha in wellness, Platinumlist in events) seeing increased revenue from their B2B SaaS components (booking software, organizer tools) vs. their transactional marketplace commissions, and what is the platform’s measured B2B switching cost (lock-in factor) in man-hours or integration expense for a merchant attempting to migrate to a generic Super-App marketplace partner?

It really depends on the product and the type of business. For example, many smaller spas, barbershops, or nail salons with only one branch or a budget-conscious audience will often use third-party software to manage their POS and booking systems — especially if it’s free, as in the case of Fresha.

However, from the tests we conducted, these platforms lack many of the advanced modules required by larger chains or luxury clinics. In particular, high-end medical or wellness providers in the UAE require EMR (Electronic Medical Record) systems that can securely handle sensitive client data in compliance with local regulations. For these players, a basic SaaS tool is insufficient, so they usually opt to build their own internal systems in-house.

As a result, the B2B SaaS components are not typically the primary revenue stream for niche vertical platforms. Instead, they are leveraged as a value-add for programmatic marketing and customer retention. What these companies really aim for is user and behavioral data — insights that allow them to build customized marketing modules and monetize through subscription or commission-based models.